Can I use the Wise Card In Korea? How To Send Money To Korea

Last Updated on April 5, 2025

Whether you’re looking to travel to Korea for the first time or you’re moving to Korea and want to be able to use your money from home in Korea easily, you should look into the Wise travel card when it comes to converting currencies and getting away from card fees and bad exchange rates. I first started using Wise when I was traveling outside of Korea and wanted to make sure I had money.

If you’re a resident of Korea and traveled abroad, you’ve probably found like me, it was hit or miss to use your local Korean cards when abroad. What’s that about? Having thoroughly tested my Wise card and converted from Korean won to USD and EUR, I was interested to see how the Wise card worked in Korea.

I recently had a friend travel from abroad to Korea and asked me if I’d recommend a card that they could use and I said definitely try Wise and let me know how it goes. Here’s how it went. (You might be wondering why I didn’t try my own Wise card. I did, but I also have local cards and speak Korean, so I wanted to see how it would work out for a tourist who can’t explain what this bright green card is and only has it to use.)

Here’s what we learned about using the Wise card in Korea:

- What to know about the Wise Travel Card

- Who can get the Wise Travel Card

- Does the Wise Travel Card work in Korea

- Benefits of the Wise card

- What are the fees?

- How to get the Wise Travel Card

- Can foreign residents of South Korea get the Wise travel card?

- How to set up a Wise Travel Card

- Using the Wise card in Korea

- FAQ about money in Korea

(This post contains affiliate links, which means I receive a certain percentage of a sale if you purchase after clicking at no cost to you. Thank you for your support.)

After I worked on a trends report regarding fintech in Korea, I was really astounded by how many options there are for various banking needs nowadays. It’s amazing how much easier it is to get money where you need it quickly and easier. After that, I wrote a guide for how to transfer money to or from Korea. I’m going one by one to test and find the best options for me and you.

What to know about the Wise Travel Card

Formerly known as Transferwise, Wise is a multi-currency travel money card that is cheap to set up and also cheap once you have it offering fee-free ATM withdrawals and you don’t have to worry about trying to visit banks or overpriced money exchange stalls. A travel money card, also called a currency card, is a type of a card which allows you to keep multiple currencies, and use the card while travelling the world with no hidden fees to worry about. You can hold up to 50+ currencies in your travel money card, and convert them at the mid-market rate with the free Wise app.

You can use the card in 170 countries around the world and you can easily convert currencies and not worry while you’re traveling. Korean companies are going more and more cashless so having a card that works in country is important. The card functions just like your standard bank card, but there are lower fees on currency exchanges and ATM withdrawals. It does support Korean Won so it’s a great card to take with you whether you’re traveling through Korea or coming as a resident and want access to your money abroad.

Note: This is not a credit card. You can’t borrow money or finance payments with it. As noted below, this card is topped up via bank transfer or debit cards. Keep that in mind. You need to add money to it to use it.

Who can get the Wise Travel Card

Currently, the Wise card is available to residents in:

| Region | Countries and Territories Eligible for the Wise Travel Card |

|---|

| Europe | Austria, Belgium, British Virgin Islands, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France (Metropolitan only), Germany, Greece, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Gibraltar, Guernsey, Isle of Man, Jersey |

| Other European Territories | Andorra, Åland Islands, Saint Barthélemy, Curaçao, Falkland Islands (Malvinas), Faroe Islands, French Guiana, Greenland, Guadeloupe, South Georgia and the South Sandwich Islands, Cayman Islands, Monaco, Saint Martin (French part), Martinique, Montserrat, New Caledonia, Saint Pierre and Miquelon, Réunion, Saint Helena, Ascension and Tristan da Cunha, San Marino, Sint Maarten (Dutch part), French Southern Territories, Holy See, Virgin Islands (British), Wallis and Futuna, Mayotte |

| Asia | Singapore, Malaysia, Japan |

| Oceania | Australia, New Zealand |

| North America | Canada, United States (except for residents of Nevada) |

| Latin America | Brazil |

Note: I think it’s important to note that users based in South Korea can’t get the card there yet. I was able to get the card when I was home in the US and then activated Korean Won and the other currencies I wanted to access that way. More information about that below.

Does the Wise Travel Card work in Korea

Simply put, yes. Great for both travelers in Korea, new residents of Korea, or digital nomads making a trip around the world, the Wise travel card is perfect for receiving payments and salary and currency from home and allowing you to spend it easily.

I did hear from my friend that her card didn’t work quite everywhere though. I think it’s important to note. She found that it worked about 95% of the time but there were a few places it didn’t work so in that case, it’s good to have that cash on hand. She mentioned Daiso as being one of those places.

The best way to send money to Korea

If you’re becoming a new resident of Korea, maybe coming to teach English in Korea, your first salary payment from your new job won’t come for more than a month. There’s always that time when newbies realize they brought enough to tide them over for the first month without realizing they’re not paid right at the end of the month and they need some help.

Prepare the Wise card before you come, and you won’t have to worry. This also makes it easy for your friends and family to gift you cash as they can bank transfer in their own currency.

If you’ll be coming to Korea as a student and need to pay for things like rent or tuition, it works for that as well and your parents can also put money on the card from their own local bank account.

Benefits of the Wise card

Wise (formerly TransferWise) has become really popular because of how easy, safe, and cheap it is to move money into different currencies and then use that money. It’s great for the user.

- Payment in local currency: Once you’ve added funds to the card, via the app, just convert those funds to whichever local currency you need. Paying in the local currency will save you money. Also, when you leave a country, just convert the rest back to your own currency. That means you aren’t left with coins and cash that is too small to convert. You can always use everything you put on the card.

- Physical & Virtual Card: You can get a physical card, but you can also use the virtual card, or BOTH, as well.

- Chip, PIN, Contactless: The physical card has all of the options you want when you’re traveling.

- ATM Withdrawal: If you want a bit of cash just in case or perhaps want to tip in Korea, you can get some out from a local ATM. You get fee-free withdrawals on the first 250USD.

- Receive Payments/Cash: Maybe you’re traveling and your mom wants to send you a financial gift or you’re working abroad and your company wants to pay you in their local currency, well you can accept payments and money via Wise as well. It’s super easy and the app provides your account details both in the info someone would need if they’re sending money from within or outside of a country with that currency. Basically, no need to look up SWIFT and IBAN codes and everything else. Just copy, paste, and send and you can get paid. Get paid in multiple currencies easily and use that money with the one card.

What are the fees?

This is a good question. There are upfront conversion fees when you exchange from currency to currency but these are much smaller than anything that would be assessed at your bank or at the airport. Additionally, there are no annual fees.

While the Wise card doesn’t have other fees on transactions, you should be careful when you take out money from ATMs in Korea. If it’s not a global ATM, the ATM service company will take out a fee. This isn’t from Wise technically, but is a fee you’ll notice.

Also, on the note of ATM withdrawals, there are limits based on where your card was issued. For example, I can get two free ATM withdrawals up to a certain amount. If I go over that amount or take out money more than two times, there will be a fee assessed. Just know what the rules are for your card. Like I said, Korea is trying to go cashless, so you don’t really need much cash in my opinion so you probably wouldn’t even notice this.

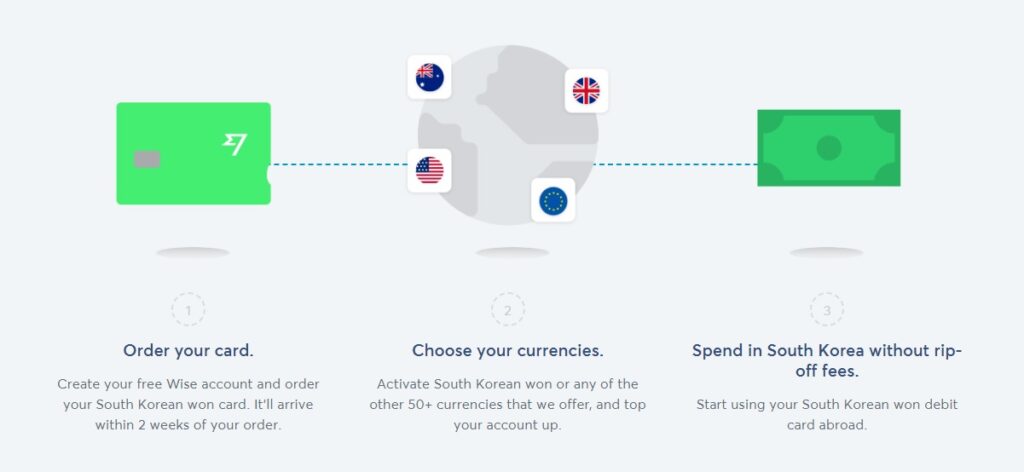

How to get the Wise Travel Card

Once confirming you’re a resident of an eligible country to apply for the Wise card, download the Wise app and apply there. You can also use the website to apply with email, Google, Facebook, or an Apple account.

Get verified: Your identity will need to be checked by checking that you have a valid mobile phone number, a government ID (a passport, or local driver’s license works), and a bank account in the country you’re applying in. After submitting the documents, the verification is pretty quick and painless. You can get your physical Wise card within a matter of days or weeks.

Order a card from them. Wise aims to get your new card to you in 3 working days if you’re in Singapore, in 2–6 days if you’re in the UK, within 2 weeks if you’re in Europe and Japan and Malaysia, and up to 3 weeks if you’re in the US, Australia and New Zealand. But how long it takes depends on the country you live in, so check the delivery estimate.

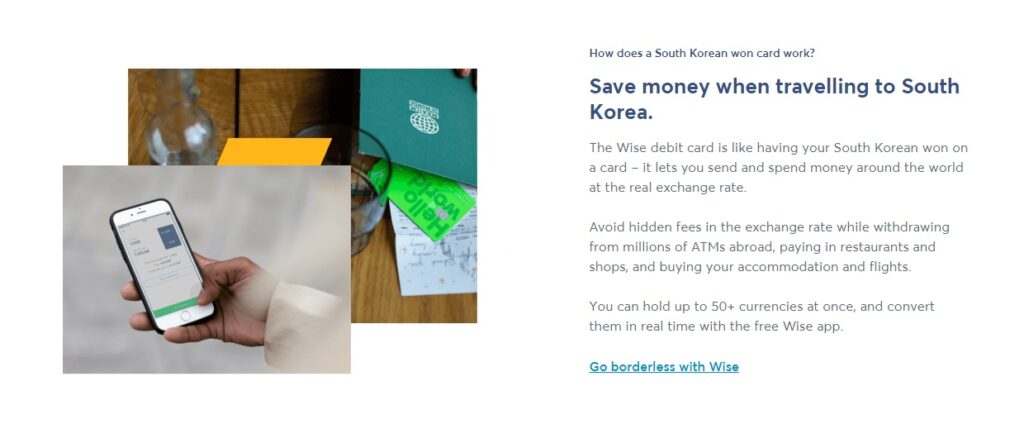

Can foreign residents of South Korea get the Wise travel card?

Technically, since Korea isn’t an eligible country for for setting up a Wise account, you can’t do it from there. But you can get a Wise card if you’re a resident of an eligible country. Like I said above, I still have a bank account, and postal address, and ID from home so when I was Stateside, I opened an account, had it activated, and got my card shipped to me.

Once you’ve done that, bring it back to Korea with you and you can use it.

How to set up the Wise card

You can top up your card via debit card or bank transfer and it’s quick and easy so you can use it pretty immediately. Remember this is not a credit card, so you need to add money to it to be able to use it. Once the balance has cleared, you can convert that money into any currency you want to use including Korean Won. There is a small conversion fee but it’s better than transaction fees at banks or exchange booths.

To activate your card, you need to use your PIN but a lot of shops in Korea don’t use Chip or Pin for purchases so the best way to activate the card if you’re already in Korea is to visit an ATM. If you try to buy something and it doesn’t ask for your PIN, your card won’t work and will tell you to go to an ATM or another merchant. The easiest way, therefore, to activate the card is to visit an ATM and withdraw some money or checking your balance.

Using the Wise Card in Korea

Korea is a country that is very card-friendly. They actually aim to be a cash-free society so you will be able to use it almost everywhere.

The card can be used anywhere from restaurants to cafes and bars and you can withdraw money from ATMs as well if you want a bit of pocket money just in case. Your Wise card will come with either Visa or Mastercard on it, the two most widely accepted methods of payment in Korea so your card will pretty much be accepted anywhere that credit and debit cards are accepted.

Remember that the card isn’t a credit card though so while it has Visa and Mastercard, it is a debit card so you can only use up to whatever your current balance is.

Make sure you download the Wise app so you can always check how much money you have and in what currency. It is cheaper to transfer money from here to there and there to here though that’s for sure.

This has quickly become my favorite card to use when traveling. While I’ve generally utilized it when I’m traveling outside of Korea since I have Korean cards, it works everywhere I’ve been and I could get my Korean Won onto the card and my USD onto the card and back and forth into other currencies as needed.

If you’re nervous that your card from home won’t work in Korea, mine didn’t when I first arrived years ago, Wise is definitely what I would recommend.

FAQ about money in Korea

What is the currency in South Korea?

The currency in Korea is the South Korean Won. This currency is available on the Wise travel card.

Do ATMs in Korea accept foreign cards?

There are two types of ATMs in Korea: ATMs that accept foreign cards and ATMs that do not. My first year in Korea, it was like playing whack-a-mole to find the ones that accepted my foreign card. The ATMs that accept foreign cards are more prevalent in touristy areas like Myeongdong, Insadong, and Hongdae. You’ll want to look for the Global logo on the front to know if your card will work in the machine. These machines also come with multilingual options.

Did you like this post? Pin iT!

8 Comments

Giulia

Hi! I loved your post and it helped me a lot to plan the rest of my trip to South Korea next month, but I have a doubt.

Lately, I saw some people commenting that their wise card didn’t work in many of establishments, they tried and some times it didn’t go and in others, the purchase was made after several tries. Have you ever experienced something like this with the wise card in Korea?

I’m afraid of going with this card because of this.

Hallie Bradley

I had it not go through a couple times and then realized I didn’t have enough Korean Won in my account. I needed to convert more USD to WON. I wonder if that was their issue?

Michelle Roulet

First, let me say your blog is fantastic, thank you so much for your brilliant information. Would Revolut work in the same way as Wise in Korea?

Hallie Bradley

I haven’t tested that card, but more and more Korea is cashless in so many ways so if it’s a credit card or similar to wise with multi-currency, you shouldn’t have a problem. Most big restaurants and shops in tourist areas will be fine. There are still some smaller mom-and-pop shops that will ask for cash and will tell you there’s a 10% increase if you’re using a card but I’d say generally you’d be good to go if you’ve traveled with it before and it worked. I haven’t used Revolut myself though so I’d ask Revolut directly if it works here.

William

Hi, I’m thinking of using the Wise Virtual Card on my Iphone Wallet. What is your experience using the digital card and do most places in Korea accept ‘tap and pay’ from the apple wallet?

Hallie Bradley

I don’t use digital wallets myself, Apple Wallet was only just made available in Korea like 9 months ago so it’s not as common as a payment method. Online it says you can use it in convenience stores and department stores, but I wouldn’t rely on that solely as your option as restaurants and cafes may not have the readers required for that kind of payment. Wise works great as a card. I’ll have to experiment with the virtual card a bit to see how it goes.

Pedro

Is this a paid advertisement for Wise?

Hallie Bradley

No, Wise didn’t pay me to write this. I started using Wise when I was traveling from Korea to the US and the EU and wanted to access my money and realized it would be good for tourists coming to Korea as well.