The Best Overseas Money Transfer Service: SentBe

Last Updated on May 4, 2025

Whether you’re trying to send money abroad to pay off your student loans or sending gifts to family, the need for easy money transfer services has grown immensely. It’s amazing how much easier it is now. I remember in 2006 when I first arrived in Korea how much paperwork at the bank it required and how long I had to sit there to do it. Now, there are apps and online services connecting banks in amazing ways.

I’ve been using SentBe for a few years now to send money home. Admittedly, after the first time, I was SHOCKED at how fast and easy it was. I used it and never went back to tedious bank transfers. Looking for a headache-free overseas remittance option? It’s SentBe.

If you’re looking for a fast, reliable, and user-friendly overseas money transfer service, look no further than SentBe!

- What is SentBe?

- Is SentBe safe to use?

- How much does it cost to use SentBe?

- Can I use SentBe to send money to my country?

- Does SentBe only work for sending money out of Korea?

- How does SentBe work?

- Steps for setting up SentBe

- Why you should choose SentBe

(This post contains affiliate links, which means I receive a certain percentage of a sale if you purchase after clicking at no cost to you. Thank you for your support.)

What is SentBe?

SentBe is an overseas remittance company registered with the Ministry of Strategy and Finance here in Korea. They’ve been registered since 2017 and guarantee a secure transfer of funds for their clients. They changed the fintech market for consumer use and offer fast, easy-to-use, and cheap methods for sending money abroad. With the launch of their global platform, they provide services worldwide to 50 countries.

SentBe has built a global network with partners like Moneygram, Ripple, and MoneyMatch Transfer. They work for sending money from South Korea, Singapore, Indonesia, and Vietnam to countries around the world.

Is SentBe safe to use?

Since their overseas money transfer service launched in 2016, SentBe has had no accidents of the estimated 1.7 million remittances abroad. Even if there were an accident, though, you are insured for up to 6.5 billion won. They conduct regular security checks in accordance with the standards set by the Korea Financial Services Agency.

How much does it cost to use SentBe?

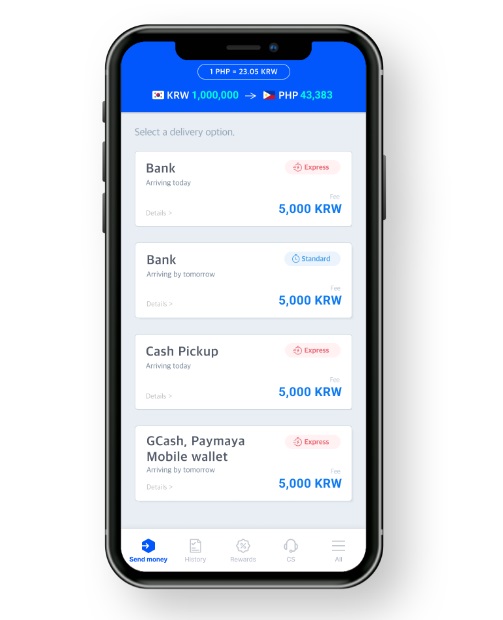

The standard transfer fee is W2,500 for processing time which can take up to 3 days. The express transfer fee is W5,000 for processing time that takes 2 business days (this excludes holidays and weekends.)

For my first transfer I used the express option on a Thursday night and my funds were in my bank in the US in less than 12 hours. I woke up Friday morning and there it was safe and sound on the other end. The fees are a lot lower than most bank fees, like 90% lower. After you’ve worked for your money, why give it away in fees when you don’t have to?

Keep your money. Send your money. See it fast.

Can I use SentBe to send money to my country?

Currently, recipient countries include:

Asia & Oceania: Australia, Bangladesh, Cambodia, China, Hong Kong, India, Indonesia, Japan, Kazakhstan, Kyrgyzstan, Malaysia, Mongolia, Myanmar, Nepal, Pakistan, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Turkey, Uzbekistan, Vietnam

Africa: Nigeria

Europe: Austria, Belgium, Bulgaria, Cyprus, Denmark, Estonia, Finland, France, Germany, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Poland, Portugal, Russia*, Spain, Sweden, UK, Ukraine

North America: Canada, US

*currently unavailable due to local circumstances

Does SentBe only work for sending money out of Korea?

Actually, you can send money from South Korea, Singapore, Indonesia, and Vietnam. SentBe is continuing to grow and expand their services so keep checking back though to see if they become available in your country.

How does SentBe work?

Just like your remittance account at your bank which you may have set up long ago like me, SentBe works similarly except you don’t have to go to your ATM or into your bank to send anything. My first few years in Korea, I had to go in each time I wanted to send money abroad. I’d always plan to be there at least two hours too. After a few years, I found out I could set up a remittance account and send it from the ATM. Cut down on the hours I wasted at the bank, but I still had to find a local ATM.

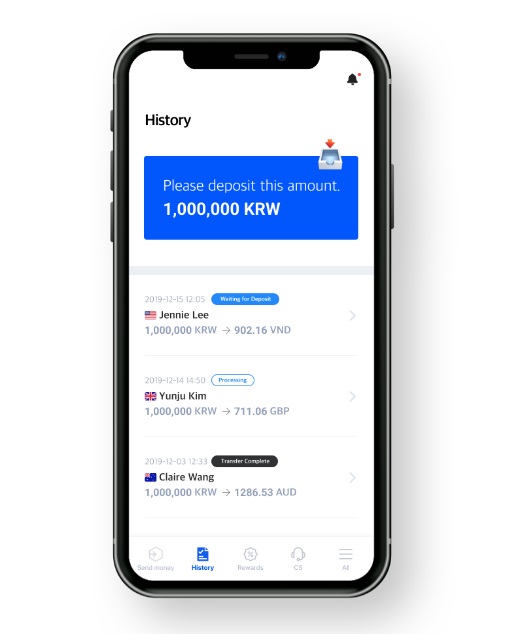

With SentBe, when you want to send money, you input how much you’ll be sending and then SentBe will send you a message with the transfer account number. You send money from your Korean bank account to this account, the remittance account, and then this money will be sent to your home account.

Just to be clearer, you hop onto your Korean account app or the website, do a quick transfer to your SentBe remittance account and then it’s done so you don’t have to go to the bank or to the ATM at all. Doing it this way cuts down on the fees associated with the remittance though. And on top of that, you can input multiple banks in different countries if they do business in them. Make it easier on yourself.

Steps for setting up SentBe

- Download the SentBe app.

- Enter your phone number, take a photo of a valid ID, your ARC or Korean driver’s license, or passport.

- Enter your bank account number in Korea.

- SentBe will send W1 to your bank account with a 4-digit verification code and after receiving, you can enter that code in the app.

- Once verified, you can start sending your money.

- Input the amount that you’d like to send and then choose “Express” or “Standard”.

- Next you can choose if you’d like to “Manually deposit” your funds or “Deposit via auto-debit”.

- If you chose “Manually Deposit”, then just send the money to the bank account in the message, email, and pop-up that is provided. If you set up auto-debit, then you’re set.

As a fun little note, SentBe is hosting an event right now in which you can win prizes when you transfer money and invite your friends. Find out more about the SentBe promotion here.

Why you should choose SentBe

Convenient and Available 24/7: Banks in Korea are closing earlier and if you have to go in, you’re going to be out of luck a lot of time. Whether you have an emergency late at night and someone needs money at home ASAP or if you just only have time to do your banking after business hours, SentBe will have you covered.

Cheaper Service Fees: If you can save money, then you should. Actually, it’s not “if”, it’s “when” in this case. Transferring money overseas via the bank will cost you a lot more with a fee assessed on this end and another fee assessed at the other end. Some services even charge the fees based on a percentage of what you’re sending so it could be even more than the flat rates that the banks charged. Either way, SentBe is cheaper. So save your money while you can!

Less Paperwork: No documents to get signed and no paper receipts. All transactions are stored in an archive that has your transaction history so there’s no paper to worry about.

Safe and Reliable: SentBe is reliable and hasn’t had any issues with millions of transfers. Even if they did though, you’d get your money fully refunded.

Fast fast fast!: I can’t say this enough honestly. I was amazed how fast my money got from Korea to the States. It’s the fastest transfer I’ve ever had and that just gives you comfort if you ask me. Living in limbo with your money out of your Korean account but not yet received on the other end for a couple days can just cause anxiety at times. Way less worries this way.

Will I go back to remittance via my trusty bank ATM? Not if I can help it. Save myself a trip to the nearest bank? Yes, I’m all for that. It also means I can send money while I’m abroad without hassle as well. If you’re like me and send money home fairly regularly or just want to send some randomly, definitely look into SentBe. It’s my go-to overseas money transfer system now.

Did you find this post useful? Pin IT!

4 Comments

Sasha Seekola

Hi, thank you for this helpful post. Just wanted to let you know that it works for South Africa as well! Keep up the awesome work! x

Hallie Bradley

Thank you for the update! Much appreciated. ^^

Elias Isaac Quezada

Do I need to be set up with online banking with my Korean account? I do have a Korean account and a debit card but I don’t use online banking. Can I still use sent be?

Thanks

Hallie Bradley

SentBe has a Korean account that you would send money to directly from your Korean account. From there, they handle getting it to your international account so you just have to be able to send domestically. You can either manually deposit the amount or you can register your local account so that it will debit the amount whenever you want to send it.